rank real estate asset classes by risk

Ad Real estate investments brought to you by true real estate professionals. Additionally two common alternative asset classes are commodities and as you may have guessed real estate.

The Monolith And The Markets Short Message Service Johnson And Johnson World

The top-performing asset class so far in 2020 is gold with a return.

. Self Storage real estate was the best performing sector for the last two years and also performed well during the 2015 market correction. 15 67 Recommendations. 11 years 3 months.

The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US. Within private equity real estate assets are typically grouped into four primary strategy categories based on investment strategy and perceived risk. Search Real estate asset manager jobs in Piscataway NJ with company ratings salaries.

You alone assume the sole responsibility of evaluating the merits and risks associated with the use of this information before making any decisions based on such information. Different states and cities can also. Commercial real estate investments can show more resilience than other investments during a recession but not all asset classes of real estate investments will be able to.

In order to qualify as an asset protection trust the grantor cannot have any control over the trust distributions. Three traditional asset classes are equities or stocks cash equivalents or a Money Market and fixed income or bonds. Im mainly looking at.

Ad Let us help maximize your leads increase sales and leverage your resources. Ad Browse Discover Thousands of Business Investing Book Titles for Less. In commercial real estate this gets defined as Class A.

As an asset class real estate investments have traditionally been ranked somewhere in between fixed income and equities as depicted schematically in the diagram below. Our investors keep coming back. As people will always need a place to live residential real estate is less sensitive to economic downturns.

When investing some assets are considered safe while others are considered risky this includes savings accounts T-bills certificates of deposit equities and derivatives. Asset class risk spectrum. Real estate has the highest risk and the highest potential return.

Asset classes in real estate are better understood if you think of them as alternative assets that fall into a. Other Property by Owner. Find real estate and property information.

In commercial real estate this gets defined as Class A B C or D. Specialty and data center sectors are excluded as this data was only available from 2015 onwards. Risks and rewards of ownership Interest rates Rents Capital gain or loss on sale of direct holdings The role of.

Learn why so many of our investors are repeat investors. Better Homes and Gardens Real Estate M3 Realty. ELIZABETH ASSETS GROUP LLC 69 ELMORA AVE ELIZABETH NJ 07202.

The trust employs a trust company to serve as the fiduciary. Data for 2021 is as of November 30. Risk and return drivers for real estate include.

The first asset class is real estate. The independent trustee is granted discretion in making. 300 Park Avenue 15th Floor New York NY 10022.

On the other hand real estate investment trusts REITs have been the worst-performing investments. It aids the investors in deciding the proper investment strategies and receiving maximum profits with minimal risk prospects. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk.

Residential real estate is something that each private person has a relationship with either as an owner or tenant. The asset classes types include fixed income cash cash equivalents equity and real estate. Information should be independently confirmed and you use the information displayed here at your own risk.

Ad Complete the CE to Renew Your License At Your Pace Online. Needless to say economic shutdowns due to COVID-19 have had a devastating effect on commercial real estate. Real estate has the highest risk and the highest potential return.

Real estate experts and investors share different perceptions when it comes to ranking property and area classes. Online Continuing Education for Real Estate and Mortgage Loan Originators By AYPO. Sales Records Comparable Sales Report Compare Taxes to Nearby.

Schedule your no cost no obligation coaching strategy session today. High risk with high return to low risk with low return. 311 open jobs for Real estate asset manager in Piscataway.

In commercial real estate this gets defined as. One example would be Real Estate Investment Trusts REITs. Real estate is a well-known asset class that has been used to build wealth for centuries defend against inflation and is sometimes referred to as recession-resistant.

-Multifamily -Retail -Office -Student living -Light industrialsLogistics -Hotels -Co-working spaces I know that there are several factors playing into this but assuming as much is equal is possible what would be a plausible ranking. Asset classes refer to a group of securities with comparable features and responses to market variations. Due to the low risk the European residential yields remain below 5 the lowest being 2 in Turkey and the highest.

The Domestic Asset Protection Trust may hold investment assets and real estate including a personal residence. Equities offer an ownership stake in a. The key differentiator between these categories is the risk and return profile.

1 These include Robert Shiller stock and real estate data Aswath Damodaran bond and cash data and Portfolio Visualizer asset class data. Apply to Junior Asset Manager Asset Manager Program Manager and more. Most will rank them on a general scale from Class A to Class C with others going as far as from Class A to Class F.

2 Because this table comes from a list of just 10 assets going back to 1972 the standard deviations of ranks are necessarily lower and arent directly comparable to the standard deviations in the. Those four categories are core core-plus value-added and opportunistic. One way that real estate investors have tried to evaluate risk of 1 The Everything Everywhere Model is made commercially available through Northfield Information Services Inc.

Including lower subcategories of each class such as A- B- and C- etc. It tends to perform well when peoples lives are disrupted such as when theyre. For investors to take on higher risks they would need to be adequately compensated for the additional risks that they bear.

Some examples of major asset classes include equities bonds money markets and real estate. The risk-adjusted performance of core and non-core funds principalagent issues in incentive fees a comparison of REITs and private real estate real estates pricing and return-generating process real estates role in a mixed-asset portfolio the strategic uses of leverage etc. What kind of building are you investing in.

Moving between those strategies is a bit like stepping up the ladder. Equities stocks and fixed income bonds are traditional asset class examples.

Robert Baguenault De Vieville Is A Graduate Of Estaca With A Master S Degree From Hec He Began His Career As A Qu Hedge Fund Manager Investing Video Services

Investment Banks Can Be Split Into Private And Public Functions Read All About What Investment Banks Do At Http W Investment Firms Investing Raising Capital

Special Dividend For Sotheby S Shareholders In March Business Bigwigs Dividend Life Insurance Policy Final Expense Insurance

Meyer Asset Management Ltd Tokyo Types Of Investment Funds Infographic Investing Finance Investing Mutual Funds Investing

Upcoming Projects In Mumbai Edelweiss Home Search Real Estate Edelweiss In Mumbai

Cnbc Bear Stearns Went Under 10 Years Ago Today Here S A Detailed Timeline Of Events And Crisis Players Invol Business Company Investment Banking Very Bad

Largest Robo Advisors By Assets Under Management Robo Advisors Advisor Management

Exchange Traded Funds Etfs Ishares Blackrock Ishares Income Investing Bond Funds

Why Should I Learn To Code 17 Reasons To Learn Programming Learn Programming Learn To Code Coding

Property In Malad Edelweiss Real Estate Advisory Practice Residential Real Estate Commercial Property For Sale

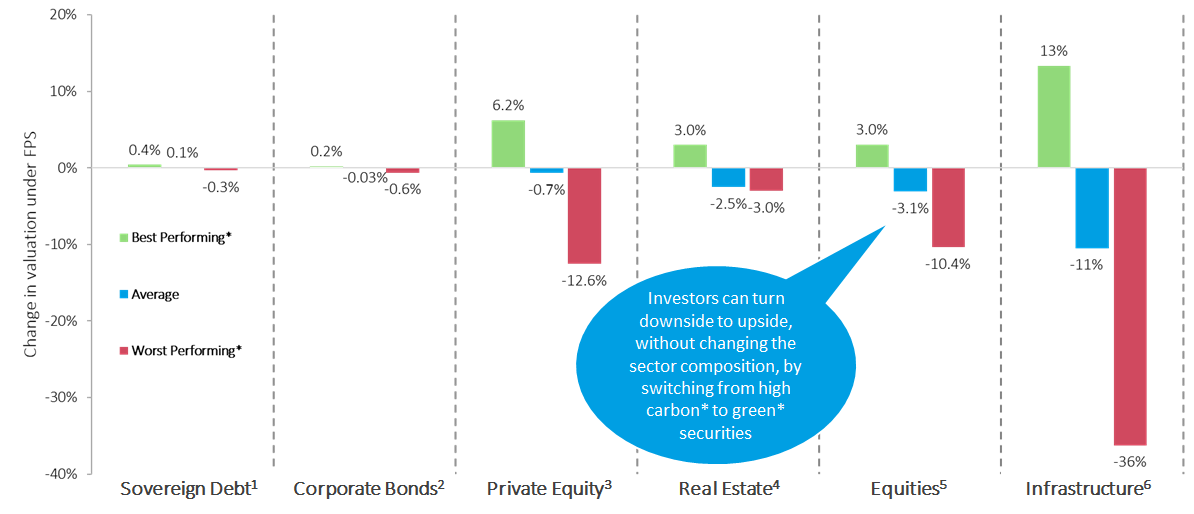

Implications For Strategic Asset Allocation Thought Leadership Pri

Hedge Funds Have Managed Volatility At The Cost Of Performance Fund Management Investing Year Of Dates

Rudra Investment After Pnb Fraud Be Alert Investor S On The Market Mutuals Funds Mutual Funds Investing Investing

Asset Management Resume Example Resume Examples Asset Management Job Resume Samples

Cumulative Preference Share Online Classes Dividend Finance

Asset Management A Systematic Approach To Factor Investing Financial Management Association Survey And Synthesis In 2021 Asset Management Financial Management Business And Economics